貝林公司是一個垂直整合的房地產開發、私募基金和移民投資平台,位於舊金山灣和矽谷。

貝林擁有60年的家庭發展和投資歷史,在高價值、多戶型公寓項目方面擁有專業知識。貝林的EB-5區域中心,伯克利區域中心基金有限責任公司(USCIS ID1316551161),為來自16個國家的投資者提供服務,迄今為止保持100%的投資者批准歷史。貝林正在為6億多美元的開發項目提供贊助。貝林是EB-5行業的創新者,提供股權和債權型投資,可以為EB-5投資者創建定制的適合自己的解決方案。

投資策略

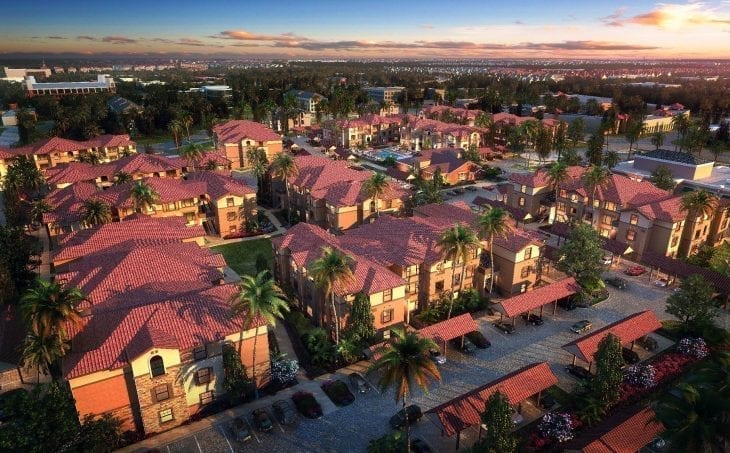

貝林的策略很簡單。作為開發商,我們將與我們的團隊一起開發房地產,並與外部開發商合資開發。我們有著長期的開發總體規劃住宅社區的歷史經驗,最近的重點是城市填充式多戶型公寓項目。 Behring資本合夥人代表Behring管理的國內私募股權基金家族,專注於利用EB-5資金的開發機會。

貝林的國際業務和關係提供了額外的資本市場選擇,包括優先債務、股權、優先股權和夾層融資。貝林管理著一家位於上海自由貿易區的私募股權投資管理公司(貝好投資管理有限公司),該公司通過能夠操縱中國資本控制,從自由貿易區獲益。貝林已經成功地為其基金進行了境外投資,投資者直接在上海認購,並成為有限合夥人,直接投資到美國的項目上。

貝林擁有並控制自己的經美國移民局認可的EB-5區域中心(伯克利區域中心基金有限責任公司),該中心提供利用EB-5投資計劃獲取額外低成本資本的途徑。

貝林一直在尋找新的機會和合作夥伴關係。請通過我們的網站查詢,讓我們知道如何合作!

Behring Capital

貝林的核心房地產開發和投資工具。

貝林的國際私募股權房地產家族基金。

BRC Legacy Fund LP(“傳統基金”)是EB-5投資者提供不同的選擇,控制和安全性。

伯克利區域中心基金有限責任公司(美國移民局ID:1316551161)是貝林經美國公民及移民服務局(USCIS)準予並全資擁有的EB-5區域中心,出於行銷目的,目前正在將其在美國公民及移民服務局(USCIS)的名稱修改為貝林區域中心有限責任公司。

選擇項目

為什麼選擇貝林

執行團隊

Colin Behring

CEO

Colin Behring是贝林资本的首席执行官,拥有超过12年的开发、投资和建设经验,包括超过400万平方英尺的10多种不同的产品物业类型。

Peter Bibler, Esq.

开发副总裁

Peter Bibler是一位在房地产、移民和消费法方面经验丰富的美国律师。加入贝林公司之前,Bibler先生负责瑞联(美国最大的私人房地产开发商之一)EB-5融资的海外市场开发业务。

Christina Ji

亞太區總經理

Christina Ji管理著大中華區的資本市場平臺。紀女士曾就職於華潤置地,中國大陸和香港最有影響力的房地產開發商之一。加入貝林之前,還曾服務於瑞聯集團,負責其在亞太區的房產營銷和移民業務。

Gao Bei

Mr. Gao Bei, as the Managing Director of the Asia Pacific region, is responsible for the operation and promotion of the entire Asia Pacific platform. With his deep experience in real estate development and professional background in the financial industry, he participated in multiple domestic and foreign market real estate development projects from 2013 to 2017. He has directly or indirectly participated in and managed a total fund size of over 3 billion RMB, and has rich experience in the development and operation of the real estate industry

Greg Sheehan

Director of EB-5 Platform & USCIS Compliance

Kyle Behring

投资经理

Kyle Behring是贝林公司的投资经理,负责投资担保、投资者关系和资本市场支持。Behring先生是EB-5政策、流程和投资移民方面的专家。

Aaron Hammon

运营副总裁

Aaron Hammon是贝林平台及其运营、财务控制和投资管理的重要组成部分。Hammon先生还拥有医疗保健技术和机构销售方面的高级管理经验。