EB-5 world encouraged as January 2024 Visa Bulletin advances almost two years to December 1, 2020 for India in the EB-5 Unreserved Category.

The US Department of State advanced the Chart A Final Action Date for India in the Unreserved Category almost two years to December 1, 2020. The Chart B Filing Date remains at April 1, 2022, which is after the March 15, 2022 effective date of the EB-5 Reform and Integrity Act of 2022 (RIA).

This article will discuss the EB-5 program, visa date movement, and the use of Dual Approval Codes by IPO to help investors access visas outside of the set-aside categories.

What is the EB-5 Program?

The EB-5 program grants permanent residency to foreign investors who inject capital into U.S. businesses, thereby creating jobs. The EB-5 Reform and Integrity Act of 2022 (RIA), created new visa categories, called “setasides” where the minimum investment amount is currently $800,000 for investments in targeted employment areas, which are High Unemployment (HUA), Rural and Infrastructure projects. 32% of all visas are allocated to these setaside projects.

Investments outside of these targeted employment areas are allocated “unreserved” and new demand for these investments is low. The minimum investment amount is $1,050,000 and very few projects are on the market in areas that are not in a targeted employment area. 68% of visas are used for these limited filings and also to service visa applications filed before the RIA.

Visa charts in the monthly Visa Bulleting help investors understand the interactions between annual limits and per-country limits. While there are also factors like carryovers and use of otherwise unused visas, below is a discussion of dual approval codes which allow for allocation between the set-aside and unreserved categories.

Chart A vs. Chart B: Deciphering the Visa Date Puzzle

The Visa Bulletin, issued monthly by the U.S. Department of State, lists two sets of visa availability dates: Chart A and Chart B.

A recent article published on Forbes helps us understand these charts. According to Charlie Oppenheim, Director of Visa Consulting at Wolfsdorf Rosenthal Immigration, when a Final Action Date is listed in Chart A, this “is intended to represent the priority date of the first applicant for who a visa number was not available during that month. Therefore, only persons with a priority date earlier than that date are eligible for potential final action on their case – resulting in visa issuance at an overseas post or adjustment of status if being processed in the United States.”

In the January 2024 Visa bulletin, this date advanced two years from December 2018 to December 2020, allowing for approved applicants with priority dates during that time frame to apply for Adjustment of Status or Consular Processing overseas. Many people who have a priority date are not processed to conclusion or have an increased family size; these factors are partly why months are used as chart references opposed to firm numbers. As monthly demand shifts, the visa bulletin could push the Final Action Date backward, which is called retrogression, or the date could progress forward toward the Chart B Filing Date, which is now April 1, 2022. Patience is key as these monthly dates can move in either direction over time and this date movement does not assure that every investor with a priority date prior to the Final Action Date has actually been cleared.

What does this mean for EB-5 investors?

As of today all of the reserved categories in EB-5 show that visas are currently available, which allows for current filing of the form I-526E Immigrant Petition by a Regional Center Investor and I-485 Application to Register Permanent Residence or Adjust Status. This window of time for today’s investors solves Child Status Protection issues as explained by Nima Korpivaara from KLD LLP, and allows for EAD and travel documents to arrive prior to the Adjustment of Status adjudication if certain circumstances are met, as explained by Peter Bibler, Managing Director at Behring Co.

EB-5 investors are watching the unreserved visa date asking, if the India unreserved category is clear by the time my I-526E gets to Adjustment of Status or to Consular Processing, can reserved investors use those visas?

Remember first of all that the Immigrant Investor Program Office (IPO) relies on fees and the United States Congress created the program to stimulate the United States economy with foreign invesmtents. Developers, job creators, American citizens, Congress, IPO employees, and investors all want to see applications in setaside categories continue above the perceived 32% supply constraint.

As I mentioned in a recent quote in EB-5 Investor Magazine, “There is this idea being promoted that High Unemployment Areas only get the first 10% and Rural areas only get the first 20% of visas, and every year you have to hope to be one of the lucky families within those small annual batches,” says Sheehan.

According to Sheehan, most Regional Center projects are in these areas of economic need and the government possesses a financial incentive to utilize all the visas and not allow 68% of visas to go mostly unused.

“IPO gave the State Department the ultimate flexibility by allowing allocation of visas to Rural and HUA projects using the unreserved surplus, subject to country cap calculations,” says Sheehan. “This is a game changer for issues like wait time and retrogression.”

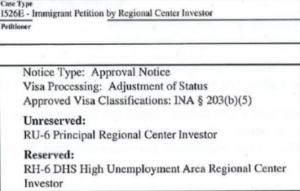

To be clear, Post-RIA Approvals are issued in both reserved and unreserved categories within the same approval notice, allowing applicants to choose the category that benefits them the most which is consitent with USCIS practice. Here’s a redacted HUA example provided by Phuong Le of KLD LLP reflecting two Approved Visa Classifications.

As recently published in an article by Joey Barnett at Wolfsdorf Rosenthal,

“Recent Form I-526E approval notices for investments in reserved visa categories interestingly list both the reserved and unreserved visa categories. The notices state: “If you are eligible for more than one visa classification, you will be required to identify the visa classification on which you will seek to adjust” or “you will be required to identify which visa classification you will seek to obtain before proceeding with immigrant visa processing.”

This optionality is similar to other categories where applicants who are eligible for immigrant visa filings can choose the faster path for them.

The US Government accounts for applicants to choose from multiple visa options.

According to USCIS.gov, the agency is dedicated to using as many available employment-based visas as possible in FY 2024, which ends on September 30, 2024.

“When estimating how many pending or newly filed applications are likely to result in visa use during a fiscal year, the agencies consider a variety of factors, including but not limited to:

- The potential that a certain percentage of applications will not be approved;

- Accounting for noncitizens who have multiple pending adjustment of status applications in different categories;

- Estimating and considering the number of family members who may decide to immigrate with the principal applicant;

- Considering where applications are in the adjudication process and how likely they are to result in visa use in the immediate future; and

- Adjustment of status applicants with multiple pending or approved immigrant visa petitions in different EB categories who may decide to transfer between categories based on which category seems most advantageous to them.”

What to watch for:

The use of Dual Approval Codes at IPO could invite promotion of economic growth by finding ways to de-stress the apparent 32% setaside category demand. If they choose to use that limit and send visas back to EB-1, or choose to waste visas without other allocation, then they could trigger the advancement of final action dates in setaside categories, foreseeably stalling income.

1 – Excess Rest of Word setaside demand could be met with unreseved visas as disclosed on the approval notices if the investor gains an advantage.

Joey Barnett again from Wolfsdorf Rosthenthal;

“This (Dual Approval Code) could allow “rest of world” immigrant investors in reserved visa categories to use unreserved visa numbers, thereby increasing the supply of reserved visas for Chinese and Indian nationals and others who could be subject to a per-country limitation due to high demand.”

2 – Rest of World setaside demand could be automatically met with unreserved visas.

Using the same methodology to use unreserved visas for reserved demand, a “rest of world” investor could choose to select an unreserved visa to process their application in a reserved category. This would essentially increase the 32% limitation for IPO and today’s investors. I imagine it would be in the best interest of IPO to automatically use unreserved visas for rest of world investors in the setaside categories in order to allow for more receipts in the post RIA HUA and Rural categories from India and China. This would help mitigate future backlogs in the interest of promoting efficiency of the service.

3 – How would this apply to recent FOIA data released to the public?

Anybody watching EB-5 knows this, but I will say it again, Matt Galati of the Galati Law Firm successfully sued USCIS to get country specific filing data. Watching the analysis of the data from last fiscal year leads to one conlusion; there’s a lot of guessing and minimal application of the use of dual approvals as cited by Joey Barnett and Charlie Oppenheim above. We would simply need to learn more about these ideas to be able to accurately analyze any data provided by USCIS to the industry, either now or in the future.

As always check with your attorney before making any decisions on visa timing but stay tuned for updates as this unfolds. Here’s what should be on your radar:

- Watch for any changes in Adjustment of Status Filing Dates,

- Watch for the Annual Visa Report from the Department of State to get additional data about FY 2023,

- Watch for updated statistical data per country as it becomes available and look for proper application of USCIS policy.

Behring Regional Center has been leading the EB-5 domestic market with direct to investor outreach, multiple investment options, Industrial grade real estate partnerships and 60 years of history developing projects in China and in the San Francisco Bay Area.

Schedule a free consultation using this link to select a time that fits your calendar.

Subscribe to our YouTube Channel for all the latest and up to date information about EB-5 including monthly Visa Bulletin analysis from Peter Bibler at Behring.