Potential Impacts of New Coronavirus Outbreak on EB-5 Investors and the Real Estate Industry

As of today, the number of people reported as infected by the new coronavirus (COVID-19) is more than 80,000 confirmed cases worldwide, with the majority of cases from China (77,780) and 2,459 in 32 other countries, notably South Korea and Italy. The official death toll has exceeded 2,700 persons. The World Health Organization’s situation report can be found here.

The origins of the new virus appear to be from Wuhan, a city of 11 million people in Hubei Province. China alerted WHO on December 31, 2019. On January 7, 2020, officials announced they had identified a new virus, a new coronavirus now referred to as COVID-19. By January 23rd, Chinese officials imposed a quarantine on the entire city of Wuhan, which later extended to several other cities. Nevertheless, infections have continued to spread in every province of China and in other countries.

US Closes Embassies and Consulates in China and Restricts Entry to US

On January 17th, the DHS Customs and Border Protection (CBP) initiated health screenings at major US airports for travelers from China. The US Embassy and Consulates in China canceled nonimmigrant and immigrant visa started to cancel appointments for January 30th-31st, later extending these cancelations through the Chinese Lunar New Year holiday period. Simultaneously, the Trump administration announced on January 31, 2020 that most foreign nationals who had recently visited China would be denied entry to the US, while some US citizens and permanent residents would be put under a 14-day quarantine. On February 5th, USCIS issued an alert that it was temporarily closing its field offices in Beijing and Guangzhou and rescheduling all previous appointments. Limited emergency appointments may be available to those with urgent travel needs and qualify for exemption under current travel restrictions, including lawful permanent residents, spouses and children (unmarried and under 21) of US citizens and lawful permanent residents).

Potential Impact on EB-5 Investors

Many EB-5 investors have likely received cancellation notices for their scheduled immigrant visa interviews. It is likely, too, that further delays in processing visa applications. Affected EB-5 investors should consult their attorneys on their options both in terms of rescheduling visa interviews, but also protecting their green card status as absences from the US of more than 6 months can lead to questioning at the airport by CPB to determine if the green card holder has abandoned his or her permanent resident status. See tips here to show evidence of intent to return to the US as their permanent home.

Potential Impact on Commercial Real Estate (CRE) Industry: Hotels and Retail Face Declines

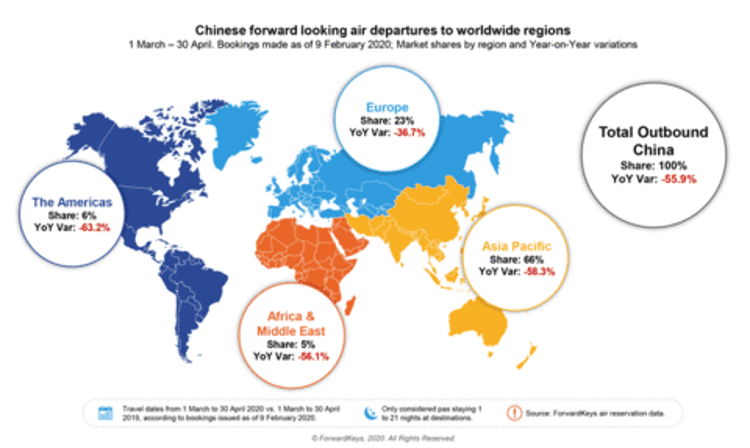

The coronavirus pandemic has substantially disrupted economic activity in China, with most factories and stores closed in China for several weeks. Would-be travelers face travel restrictions in the US and in Asia (e.g. Vietnam has suspended visa service and flights from China). Delta, United and American Airlines have suspended most direct flights to and from China through the end of April.

The commercial real estate services and investment firm, CBRE, recently published a report estimating the potential impact on CRE sector. Using the SARS outbreak in 2003 as a base of comparison, CBRE notes that while COVID-19 seems to be less fatal than SARS, the new coronavirus is substantially more infectious, with 9x the number of people infected. Another key difference is that in 2003, China’s share in the world’s was 4%, but it had grown to 16% in 2019. China also accounts for more than 20% of global manufacturing output, and the quarantines and factory shutdowns in China will certainly impact the global supply chain.

Those real estate assets most sensitive to market fluctuations will be hit first, viz. hotels and retail. Concomitant with reduced travel is the reduction in hotel bookings, especially in gateway cities such as New York City, Los Angeles, and San Francisco frequented by Chinese tourists and cities with the greatest Chinese share of overseas visitors, such as Seattle. Retail will likewise experience a downturn due to fewer tourists. The least impacted is multi-family housing. Performance of such assets do not depend on tourism.

Hotel and retail asset categories will likely experience an economic impact from the COVID-19 outbreak during the first quarter 2020, but January and February are generally slower months. Should this outbreak transform into a protracted pandemic and travel restrictions extend into the spring and summer, then we can expect further impacts, such as canceled events, conferences, further reduction in travel and shopping, causing businesses and consumers to scale back their activities.

For more information about the pandemic and how to protect yourself and your families, please consult WHO’s advice for the public on COVID-19. Behring wishes families in areas impacted by this virus to be safe and healthy during this difficult period. Should EB-5 investors have questions about the impact the coronavirus pandemic may have on EB-5 visa process or the commercial real estate industry, please feel free to reach out to us.