EB-5 Legislative Debate – The Case for Permanent Reauthorization of the EB-5 Regional Center Program

EB-5 Legislative Debate – The Case for Permanent Reauthorization of the EB-5 Regional Center Program

The EB-5 Regional Center program has officially lapsed as of July 1, 2021. The EB-5 Regional Center program is no longer accepting new petitions and existing investors in the middle of their processes are on hold in what USCIS refers to as abeyance. Click here to see current USCIS guidance during this period. For the EB-5 Regional Center Program to continue its mission of attracting foreign direct investment, creating jobs for American workers and promoting economic growth, congress needs to pass legislation to reauthorize the program. Long term reauthorization would bring stability, invite strengthened integrity measures, and deter fraud, but certain politicians are weary of allowing the program a long-term extension where they could lose their highly valued “gate-keeper” status going forward.

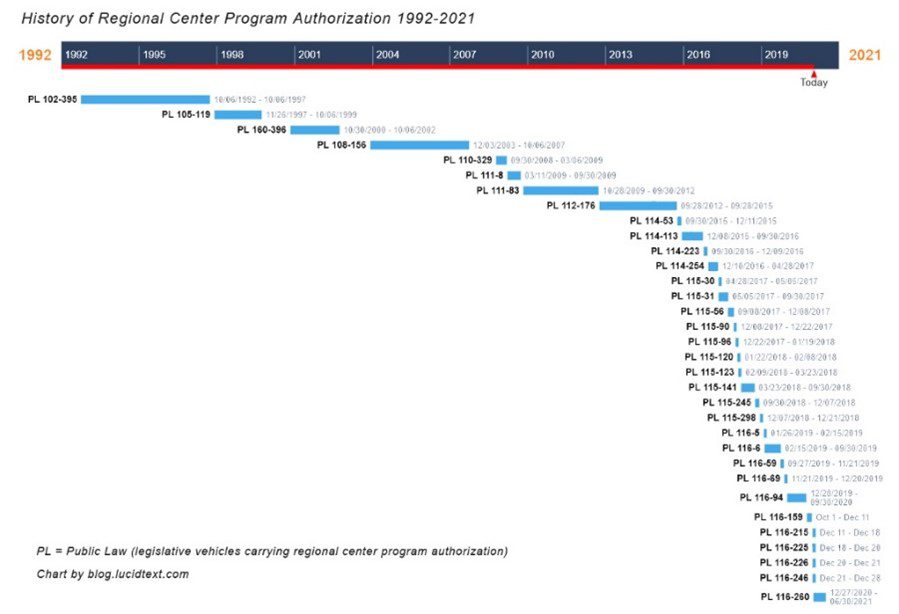

Background on EB-5 Regional Center Program and Extensions: The EB-5 regional center program has been referred to as a “pilot” program for 29 years, all the way back since 1992. The EB-5 Regional Center Program is hardly a “pilot” anymore and by comprising over 95% of all EB-5 investment volume, it is now the de facto “EB-5 Program”. The EB-5 Program’s history of 32 separate extensions, repeated threat of expiration and zero predictability has been disastrous for protecting program integrity and credibility.

EB-5 Reauthorization History Chart by Lucidtext

Every time the program seems on the verge of extinction, a mad rush of investors eager to secure “the last chance” pour into projects. Devoid of time, investors are prone to conduct little due diligence and hastily jump in. No one wants to invest this way, but somehow a “government” induced deadline gives it false legitimacy. With this continued and repeated disarray, Investors are losing faith in USCIS, Regional Centers cannot invest toward the program for the long term and it is almost impossible to convince a high-quality professional to join the team and invest their personal career in a program that seems under constant threat of expiration. Nevertheless, the EB-5 regional center program has performed remarkably for the U.S. Economy. If only judged by its merit, the EB-5 regional center program would be a unicorn government economic development program. EB-5 regional center investments have brought in over $20 billion in investment, created over 730,000 jobs and it is all at zero-cost to U.S. taxpayers. Every U.S. senator deeply involved in legislation to improve the EB-5 program, whether it be Chuck Grassley, Patrick Leahy, John Cornyn, Chuck Schumer, or Lindsay Graham, everyone is targeting enhanced integrity measures as a top priority. Integrity measures are referred to policy and regulations that will detect and deter fraud, increase transparency, and protect the program from bad actors. If those items are in fact the primary objective, what is the appropriate term length of reauthorization?

Legislative Criterion for determining EB-5 Regional Center Program term length

Before proposing a solution, we should first identify and define the criterion that would determine a successful outcome. Based on our industry experience, deep market knowledge and our own operational expertise we are identifying three critical criteria for an appropriate term length of the reauthorization.

The EB-5 Regional Center program reauthorization term length should extend at least the length of a single “full-cycle” EB-5 investment; From before a Regional Center’s I-924 filing to an Investors final I-829 approval.

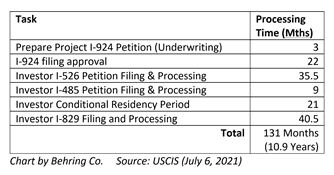

It makes practical sense that a government authorized immigration investment program should be authorized to last longer than it takes to actually complete at least 1 full-cycle investment process from start to finish. According to USCIS website, the low-end estimate for a “full-cycle” EB-5 investment from the time an initial project petition is submitted (referred to as a I-924 petition) to when an EB-5 investor receives their final I-829 petition approval is now potentially 131 months. Below is a chart extracting the expected processing times direct from the USCIS Website.

In practice, Behring Regional Center has seen processing times vary wildly with little rhyme or reason as to why. These processing times are also with no retrogression or backlogs.[1]

So, what can we take away from the data? Policymakers who advocate for a term length shorter than a single full-cycle investment are guarantying the investor, operators and the investments themselves a significant future of instability and potential failure. They will end up directly back where we are now, stuck in political dysfunction, project and investor futures hanging in the balance and everyone subject to nauseating stress levels.

Thinking rationally, why should an investor sign up for a program that is already expected by lawmakers to expire prior to a single investor being able to finish a single full-cycle investment? Does congress want EB-5 policy that is designed to fail? Based on the above chart, there is no way to justify a term shorter than nearly 11 years unless processing times are addressed directly.

If existing retrogression already indicates that the term length required to complete an EB-5 investment is more than 10+ years for countries such as China, then one could say the needs at least a 20-year reauthorization to make good on the promises made by USCIS. Afterall, USCIS is taking fees upfront for the EB-5 process from each and every petitioner. There is absolutely no rational argument why someone should sign up for an investment or immigration program that is mandated to expire before the goals of the program can be realized under their own published processing times.

The EB-5 Regional Center program term length should not foster an environment conducive to perpetuating fraud or deception via creating false deadlines, rushed decision making and robbing investors of time to properly conduct due diligence.

Time (and lack thereof) obscures rational investor behavior, forces investors into the “fog of war” and is the single largest factor enabling fraud, deception, and ultimate disappointment in the EB-5 industry. This is also easy to fix if Congress has the willingness to do so.

To exemplify how the constantly expiring nature of the EB-5 regional center program erodes program integrity, you can reference FINRA’s website: “How to spot an investment scam in 6 steps”. Here investors get simple and effective advice on how they themselves can identify and avoid investment scams. We will show how these relate to the EB-5 investing environment as well. Here is an interpretation of FINRA’s list but in relation to EB-5:[2]

- Verify Credentials: FINRA talks about not falling for fancy title or other trappings of success. The website further mentions how commonly fraudsters will go to great lengths to create the aura of success without actually having it. With a constantly expiring program, without time, investors cannot verify anything. Fraudsters hope that if you do not have enough time and you need to rush, you will not check credentials. Checking credentials does not stop at just the investment sponsor, but it should include participating brokers, consultants, attorneys and other participants to make sure interest are aligned and everyone is acting with integrity. You should always be able to have sufficient time to review information, confirm your interest are aligned and verify the integrity of the offering. When EB-5 investors face rapid and repeated expiration of the program over and over, this is impossible.

- Don’t chase “phantom” riches (or phantom immigration benefits). FINRA comments on avoiding the “too good to be true” fallacy. EB-5 inherently comes packaged with the allure of a green card, a strong enough motivator and deep enough “niche” category to drive someone to take less precaution than they would in other investments. The added element of a rushed timetable exacerbates the risk. Time determines how much you can evaluate an investment’s business plan. EB-5 investors are typically not professionals in the assets that the broad market seems to favor investment in, which means even more time would be required to verify inputs and check third-party resources. Without adequate time, being rushed to beat false deadlines due to program expiration, you are more susceptible to fraudulent schemes.

- The “everyone is doing it” trap: FINRA hits one of the strongest culprits and enablers of fraud when addressing the pitfalls of a “herd mentality”. In EB-5 investing, what is even more powerful and possibly more debilitating is the “affinity fraud”, scams that prey upon members of the same social circle, religious group, or ethnic background. The sheer act of banding together to venture internationally in search of a new life makes the affinity fraud particularly destructive. Without time, Investors potentially will try to expedite processes and just copy what everyone else is doing, whether it makes sense or not. Because you lack time to confirm critical facts puts you at even greater risk. The herd mentality turns into a powerful and destabilizing stampede when the program is expiring again and again.

- Refuse to be rushed: FINRA’s fourth point says exactly that. Program expirations, false deadlines and industry-wide “Doomsday” events create a rush veiled in legitimacy because policymakers created it. It is dangerous to investors and makes them susceptible to making poor decisions themselves or being dupped by opportunistic fraudsters.

- Never feel obligated: If your immigration investment opportunity is expiring due to government policy, you will be obligated to choose fast. The fact that it is government policy that causes the rush gives it legitimacy and may coax investors into letting their guard down. The decision carries intense emotional obligation when families are considering their children’s future, how to bring family together or how to escape religious persecution in their homeland. Having sufficient time to decide would reduce the pressure of obligation.

- Arm yourself with information: Without time, you can’t afford time for gathering information. If knowledge is power, then those who are rushed potentially don’t have any. Other policy can supplement here to require stronger disclosure and make useful information more readily available

FINRA themselves tried to provide tools to protect investors from falling victim to investment fraud but with a constantly expiring EB-5 Regional Center program, policy makers rob EB-5 Investors of all 6 tools. EB-5 investors are constantly facing a looming expiration and absurdly rushed to make an incredibly important investment decision. The stakes are too high for these families not to act; thus they feel demanded to sacrifice “time”, and even worse, proper due diligence.

The EB-5 Regional Center Program Reauthorization Term Length should bring strong credibility to the EB-5 program as an investment category, promote long term investment into integrity measures, attract high quality and talented people and companies and improve EB-5 investment environment through enhancing competition among participants.

Achieving long-term reauthorization of the EB-5 regional center program will bring credibility to the program as a whole. Previously relegated as a small “niche” industry, the program has had dark clouds hanging over it because of constantly looming expirations. High quality projects, sponsors and even new professional talent are not enticed to embrace the industry because of the heightened uncertainty over the EB-5 Regional Center programs future. Legislators can fix these poor optics simply by providing a show of faith in the program with a sufficient long-term reauthorization to encourage wide-spread industry participation, investment growth and then enjoy the vast integrity improvements healthy competition would bring.

When demanding integrity measures, it requires cost, effort and investment. To put in strong compliance, governance and integrity measures takes significant investment and the cost to do so is less daunting if you are certain to have a longer period in which to recoup such costs. A long-term reauthorization would go a long way in providing the proper motivation to improve platforms, become more appealing to investors and improve program integrity over the long term. The program would become even more attractive to increasing integrity measures if there was the added economic incentive of strong industry growth, but that is a whole different discussion regarding backlog reduction, increasing visa availability and the potential for advanced parole.

Legislative Proposals on Term Length

S.381 – Grassley & Leahy – Proposal of 2 Years

The Grassley bill started out with 5 years and then decayed in the waning moments of a vote down to 2 year “kick-the-can” result. This would inevitably result in another expiration and subject Investors to the same punitive and rushed environment. This proposed term extension in no way will increase program integrity to government, industry professionals, investors, or anyone. EB-5 will not gain any credibility by going in this direction.

Previously proposed S.2778 – Rounds, Cornyn, Graham– Proposal of 5 Years

This previous bill that positioned itself as holistic reform suggested a reauthorization of 5 years. The limited 5-year window is better than 2 years but is still covers about half of an expected EB-5 investment cycle.

What Term Length Would Maximize Integrity? Permanent Reauthorization

Looking at history, previous term precedents, extension lengths and even the two alternative legislative proposals above are based on irrelevant history, processing times of yesteryear and inertia. Holistic and adequate reform requires designing policy based on reality, or at least based on the reality intended to be created. Congress has an opportunity to look at this objectively and steer the program in a direction that fosters credible policy, high integrity amongst industry participants and ultimately deters fraud.

If you were to select a policy term length that was solely dedicated to stamping out fraud, you would make the program permanent. Any other suggested term length pales in comparison when focusing on mitigating fraud and deception. A permanent term length allows the industry to invest in infrastructure including integrity measures, allow the industry to attract talented and high-quality professionals and most importantly, lift the “fog of war” created by false deadlines and “expirations” and allow investors sufficient time for proper and thorough due diligence.

Not all investments are successful. Time for due diligence allows an investor to properly own their investment decision, have accountability and take more responsibility for their final choice in EB-5 investment. Just like FINRA on its website, USCIS can post guidance on measures and tactics that can be used to avoid scams, fraud and overall disappointment. Investors should still be reminded that government regulation and integrity measures do not guarantee investment success but if they had time to fully access numerous resources in which to conduct due diligence, then responsibility could respectably lie more with the investor and not government. As of right now, government does should some blame for creating this environment of constant expirations, hasty decision making and enabling fraud and deception to hide in the midst.

When Congress considers reauthorizing the EB-5 program, the single most powerful anti-fraud protection and integrity measure they could implement is to make the EB-5 Investor program permanent. No more expirations, no more artificial deadlines, no more rushing investors into hasty decisions, exactly what FINRA warns not to do. Congress should acknowledge this deficiency, correct it, and not let bad policy rob investors of “time”, the single most effective fraud prevention tool that should be accessible by everyone.

[1] https://egov.uscis.gov/processing-times/.

[2] https://www.finra.org/investors/how-spot-investment-scam-6-steps